how much taxes are taken out of paycheck in michigan

Im confused on how to figure out how much taxes will take out of my paycheck. In Michigan all forms of compensation except for qualifying pension and retirement payments are taxed at the same.

Michigan Paycheck Calculator Smartasset

Michigan allows employers to pay.

. Michigan Income Tax Calculator 2021. The state tax year is also 12 months but it differs from state to state. How much taxes is taken out of a students paycheck in michigan - Answered by a verified Tax Professional.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. We use cookies to give you the best possible experience on our website. How much taxes is taken out of a students paycheck in michigan - Answered by a verified Tax Professional.

Annuity payout after taxes. Some states follow the federal tax year some. Your average tax rate is 1198 and your marginal tax rate is.

How much taxes are taken out of paycheck in michigan. Your gross pay is your total earnings from your pay period before taking out any deductions. How do I calculate how much tax is taken out of my paycheck.

The income tax is a flat rate of 425. If you make 70000 a year living in the region of Michigan USA you will be taxed 11154. The overall odds of winning a prize are 1 in 249 and the odds of winning the.

Press J to jump to the feed. Use ADPs Michigan Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Employers must report new or rehired employees within 20 days of hire through the Michigan New Hires Operation Center.

Hey so Im 16 years old and Im hoping to get a job soon in Michigan. How You Can Affect Your Michigan Paycheck. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

This Michigan hourly paycheck. In Michigan adjusted gross income which is gross income minus certain deductions is based on federal. The federal Fair Labor Standards Act FLSA and Michigans Payment of Wages and Fringe Benefits Act PWFBA allow employers to take legally authorized and voluntarily agreed upon.

Calculating your Michigan state income tax is similar to the steps we listed on our Federal. Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan. On 10200 in jobless benefits.

Supports hourly salary income and multiple pay frequencies. So the tax year 2022 will start from October 01 2021 to September 30 2022. 2 days agoThe jackpot for Saturday nights drawing is now the largest lottery prize ever at an estimated 16 billion pretax if you were to opt to take your windfall as an annuity spread.

This free easy to use payroll calculator will calculate your take home pay. Lump sum payout after taxes. Just enter the wages tax withholdings and other information required.

Tax Cuts Are Coming But Michigan Is Already A Low Tax State Citizens Research Council Of Michigan

How Much Money You Take Home From A 100 000 Salary After Taxes Depending On Where You Live

State Representative Tommy Brann Facebook

Michigan Garnishment Laws Acclaim Legal Services

This Bill Could Make Social Security Taxes Could Be A Thing Of The Past

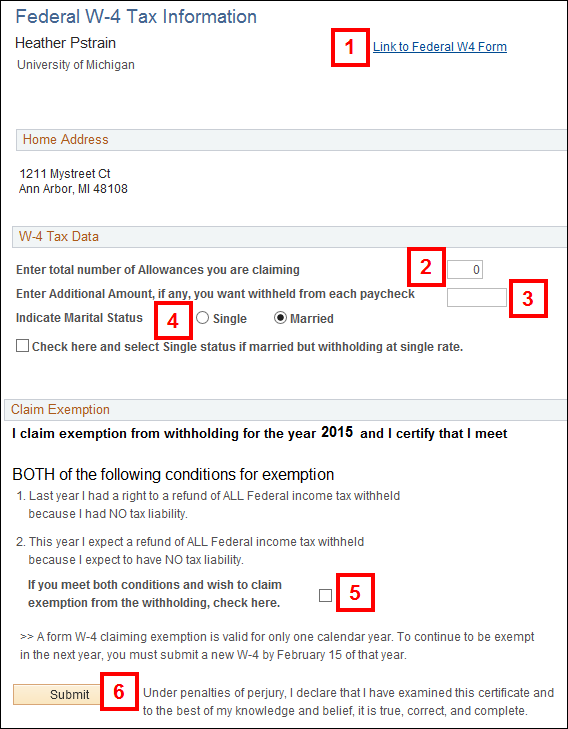

Help Federal W 4 Tax Information

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Can You Opt Out Of Paying Social Security Taxes Mybanktracker

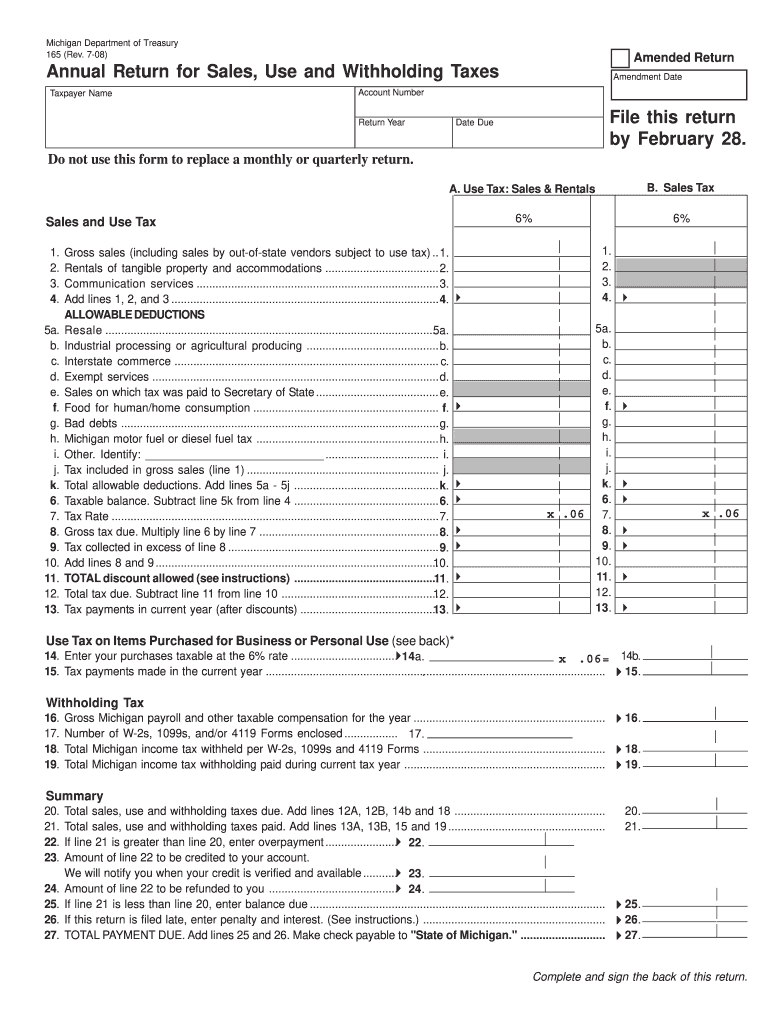

Michigan Form 165 Fill Out Sign Online Dochub

Free Michigan Payroll Calculator 2022 Mi Tax Rates Onpay

What Is The Eitc Michigan Free Tax Help

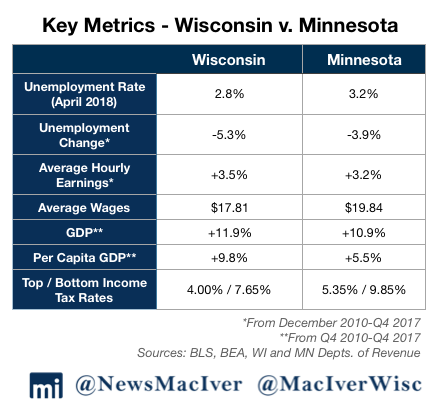

Data Wonk Comparing Wisconsin And Minnesota Urban Milwaukee

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

Michigan Payroll Services And Regulations Gusto Resources

Michigan Tax Return Form Mi 1040 Can Be Efiled For 2022

Opinion Expand Michigan Earned Income Tax Credit With Budget Surplus

Senior Cost Analyst Salary In Detroit Mi Comparably

A Complete Guide To Michigan Payroll Taxes

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back